tax on venmo cash app

Rather small business owners independent contractors and those with a. Beside this can I use cash App for my tax return.

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

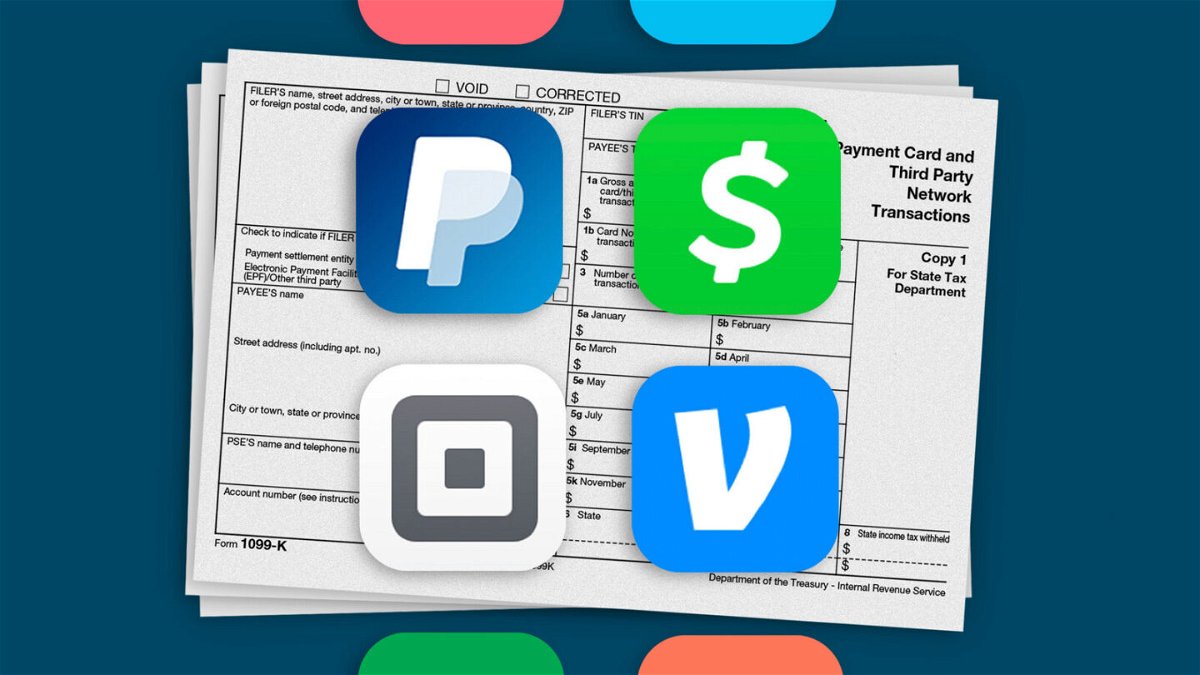

Currently cash apps are required to send you 1099 forms for transactions on cash apps that exceed a total gross payment of 20000 or exceed 200 transactions total within a single calendar year.

. Under the American Rescue Plan changes were made to Form 1099-K reporting requirements for third-party payment networks like Venmo and Cash App that process creditdebit card payments or electronic payment transfers. The Internal Revenue Service released its tax changes that will affect businesses and services who use payment apps like Venmo Paypal and Cash App. Heres who will have to pay taxes on.

The change begins with transactions starting January 2022 so it doesnt impact 2021 taxes. The changes to tax laws affecting cash apps were passed as part of the American Rescue Plan Act in. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions.

The Internal Revenue Service is cracking down on people who underreport earnings received through digital payment apps such as PayPal Venmo Cash App Zelle and others. This is probably most important for large transactions like splitting a beach vacation rental or something similar. Venmo CashApp and other third-party apps to report payments of 600 or more to the IRS.

There are no monthly fees attached to business accounts but Venmo charges sellers 19 plus 010 per transaction through the app. You wont have to automatically pay taxes on all the money you received through Venmo or the Cash App but this does increase the importance of putting in useful notes on transactions. Theres a lot of chatter online about a new tax reporting requirement that applies to users of third-party payment processers like Venmo PayPal Zelle and Cash App.

Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K. Money received from a friend as a gift. Under the prior law the IRS required payment.

1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. When you make a payment using a credit card on Cash App Square adds a 3 fee to the transaction. Now nearly everything is on an app such as Venmo Paypal Zelle and Cash App.

Standard transfers on the app to your bank account take two to three days and are free while instant transfers include a 15 fee. Here are the rules around third-party cash apps and the forms youll need for the 2021 tax year. Si tu recibes dinero a través de las aplicaciones como Zelle Venmo Paypal Cash App por venta de productos o servicios SI debes reportarlo en tus Taxes de.

Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. Starting this year the IRS is legally requiring all transactions totaling over 600 dollars on third party apps like CashApp and Venmo to be reported. Under the American Rescue Plan a provision went into effect at the beginning of this year that directs third-party payment processers to report transactions received for goods or services totaling over.

Do I Have To Pay Taxes On Cash App Such As Venmo If I Sell My Personal Items. Lets suppose you bought an item for personal use for 1000. Cash App for example tweeted on Feb.

Transactions that can be excluded from income include certain kinds of P2P payments as well as other types of payments such as. The new rule which took effect. This will change the way that you file your taxes next year.

Small businesses who used Venmo or other tax apps could now face taxes. The IRS is cracking down on payments received through apps such as Cash App Zelle or Paypal to ensure those using the third-party payment networks are. The American Rescue Plan made changes to the requirements for the 1099-K form in reporting payments or money transfers by payment apps like Cash App and Venmo.

Through 2021 the law required third-party settlement providers to report to the IRS any user who received at least 200 commercial transactions totaling at least 20000. Generally this would be excluded from gross income and will not be subject to income tax. Yes you can use cash app for the.

Beside above how much tax does Cash app take. The new reporting requirement will begin with the 2022 tax season and have no effect on 2021 taxes. Theyre very common and theyre very useful said Whitney Adkins with.

Venmo business accounts are subject to tax reporting. 4 that it will send 1099s just to users enrolled in its Cash App for Business program. However it is always a good idea to consult a tax professional.

You sold it for 900 and received payment on Venmo. Mendelson Clinical Assistant Professor of Accounting at UAH says Theres no telling how many. New Cash App Tax Reporting for Payments 600 or more.

Payment apps starting in 2022 will be required to file a Form 1099-K for commercial transactions of 600 or more a year. Beginning with all transactions from January 1 on income received from goods or. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle Cash App or Venmo.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Venmo Cash App and others to report payments of 600 or more. Money received from a roommate to pay their portion of the bills.

SAN DIEGO Small businesses have faced incredible hardships during the COVID-19 pandemic and more challenges are ahead in 2022. Cash App Transactions That Are Not Taxed. While Venmo is required to send this form to qualifying users its worth.

The business or individual who receives a form will then need to report. Here are some details on what Venmo Cash App and other payment app users need to know. Not all cash app transactions are taxed.

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

Paypal Venmo And Cashapp Will Report Taxes Exceeding 600 To Irs As Biden Government Passed The Law Lee Daily

New Tax Law Irs Wants To Tax Cash App Venmo Zelle Transactions Small Business Princedonnell Youtube

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

/images/2022/02/08/cash-app-and-venmo.jpg)

What Venmo And Cash App Users Need To Know About New Tax Rules Financebuzz

Venmo Cash App Can Be Risky Warns Consumer Group

Does The Irs Tax Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know World Time Todays

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Nation World News Komu Com

Does The Irs Want To Tax Your Venmo Not Exactly

New Irs Rule Requires Paypal Cashapp To Report Payments Over 600

Paypal Venmo Cash App And Most Payment Apps To Report Payments Of 600 Or More

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

Cash App Vs Venmo How They Compare Gobankingrates

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Kesq

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600